Q3 Trading Update

PZ Cussons plc today issues a trading update for the third quarter, ended 28 February 2022.

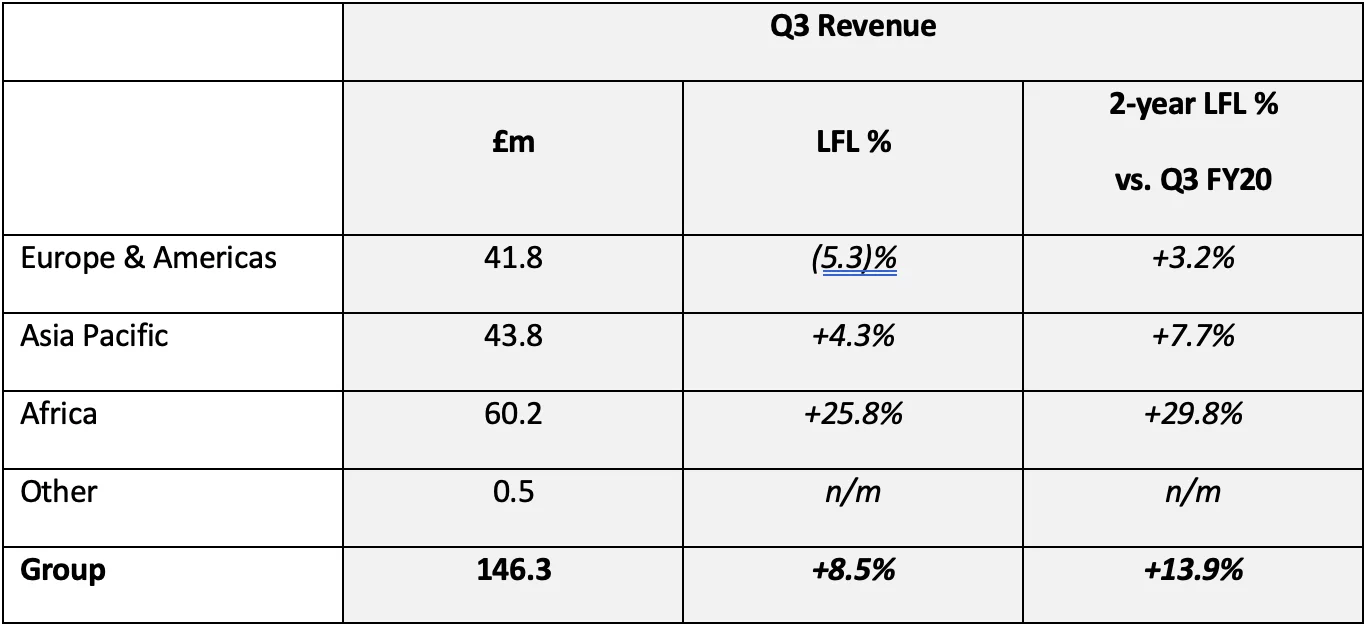

- Q3 like for like revenue growth(1) of +8.5%, driven by price/mix contribution of over 8%, with volumes maintained

- Continued improvement in revenue trends following -9.3% revenue decline in Q1 and +5.5% growth in Q2, resulting in YTD LFL revenue growth of +1.3%

- Must Win Brands revenue improved to flat year on year, and grew +12.6% versus Q3 FY20

- Cost headwinds in the quarter partly offset by pricing and productivity actions, enabling continued marketing investment to build our Must Win Brands

- Simplification of our Nigeria business is ongoing, including realising an additional £4 million gross proceeds from the sale of residential properties, with further sales expected in Q4

- Acquisition of Childs Farm, the UK’s leading baby and child personal care brand, which we will seek to expand internationally while strengthening its position in the UK

- FY22 outlook unchanged. Expect to deliver growth in like for like revenue and adjusted PBT within the range of current expectations

Jonathan Myers, Chief Executive Officer, commented:

“It is just over a year since we set out our new strategy, to return PZ Cussons to sustainable, profitable revenue growth. We are focusing on building our Must Win Brands, driving executional excellence, dramatically reducing complexity and transforming our functional capabilities. We are aligning our portfolio around the core categories of Hygiene, Baby and Beauty and our priority markets. Our strategy is working, with revenue momentum from our Must Win Brands improving, and up 12.6% compared to before the pandemic. We also have a stronger portfolio following the disposal of non-core assets and the recent acquisition of Childs Farm.

The external environment is amongst the most challenging many of us have seen. Input costs have continued to escalate in recent weeks, and it is likely that household budgets will soon come under pressure. Our teams are working hard to address both of these dynamics. We are removing costs that the consumer does not value, and have plans in place to meet evolving consumer needs, including innovation to offer everyday great value as well as more premium-priced launches. While the coming months will continue to be challenging for us and the wider consumer goods sector, the strength of our brands and our strategic progress gives me confidence in the long term prospects for the business.”